WhiteCoatInvestor.com

Planning for the Future

Life is fragile and undetermined; care enough for your family, in whatever form it takes, to have your affairs in order.

Estates/trusts/beneficiaries:

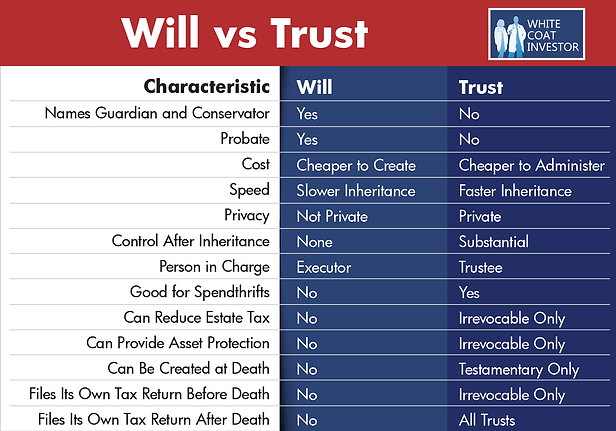

Wills

A testamentary will is a legal document that spells out how you want your affairs and assets handled and distributed after you die. It can include a directive on how you want your funeral or memorial to be held. A will is processed through the probate court which may take 6-18 months to sort out and cost 2-4% of the estate assets.

If you die without a will, called intestate, the state gets involved, and will oversee the distribution of your assets. You have no control over your assets.

Living Trust

A Revocable living trusts is created to protect assets from probate and provides ease of transferring property and assets to beneficiaries called trustees. The trust is revocable and may be changed by the creator, the truster, who maintains ownership while alive. After death of the trustor the property passes to its beneficiaries immediately without court or attorney involvement.

Once a trust has been formed with the assistance of an attorney it can readily be amended. A trust protects your assets and allows property to be distributed as you have declared.